WHAT IS SOCIALIZED HOUSING?

The term “Socialized Housing” in the Philippines has undergone drastic changes in its definitions. Originally it was used as a term to describe housing projects with different technical standards so as to ensure affordability to average and low-income families (BP 220). In 1986 when Executive Order 90 was passed during the Revolutionary Government the National Shelter Program was established to cater to low-income earners who must be members of GSIS, SSS or HDMF to avail of the Integrated Housing Finance System or the Unified Home Lending Program. In this context “socialized housing units” are those conforming to BP 220. When RA 7279 or the Urban Development and Housing Act was passed in 1991, “Socialized Housing “ was defined to refer to housing programs and projects covering houses and lots or home lots only undertaken by the Government or the private sector for the underprivileged and homeless citizens, thereby expanding the scope of BP 220.

BP 220 : Socialized housing refers to housing units which are within affordability level of average and low-income earners which is 30% of the gross family income as determined by NEDA

RA 7279 : Socialized Housing refers to housing programs and projects covering houses and lots or home lots only undertaken by the Government or the private sector for the underprivileged and home- less citizens which shall include sites and services development, long-term financing, liberalized terms on interest payments, and such other benefits.

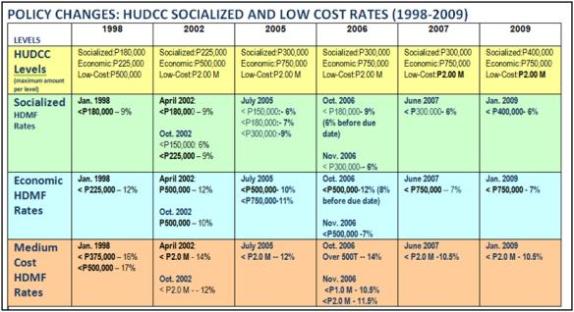

As a practice the term “Socialized Housing” began to be referred to as “Socialized Housing Ceiling” or to the value of a housing unit/loan that could be eligible to subsidies and other incentives (Abot Kaya Pabahay Law, CISFA, HGC Act of 2000). The HUDCC has periodically adjusted the Socialized and Low-Cost Housing Ceilings in response to changing economic situations.  Through the years, the data on socialized housing production has shown a decline in availment particularly in the formal housing market:

Through the years, the data on socialized housing production has shown a decline in availment particularly in the formal housing market:

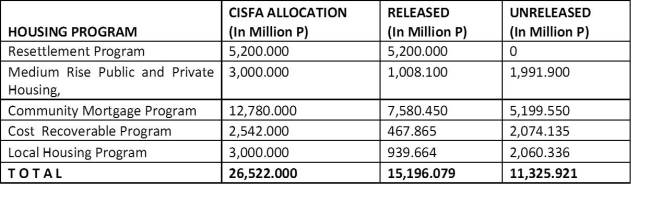

It should be noted that since its inception in 1986, the National Shelter Program was mainly funded through contributions from the Social Security System, the Government Service Insurance System and the Home Development Mutual Fund. Hence its scope was only to those members of these pension funds who are mostly income earners in the formal sector. When the Comprehensive Integrated Shelter Finance Act (CISFA) was passed in 1995, the National Government committed funds for Resettlement Program, the Community Mortgage Program and other housing programs to support the housing efforts.

It could also be observed that the focus of government was providing housing units and less on the other programs such as sites and services development, slum upgrading and other housing assistance.

Are Socialized Housing Programs Responsive to the Current Needs?

There are troubling insights on how socialized housing programs have fared so far:

- Developers have been reluctant to offer “socialized housing units” citing slim margins and difficulty in finding suitable locations.

- Developers have difficulty in complying to the Balanced 20 Percent Requirement of UDHA and have sought concessions.

- Majority of foreclosed housing units under HDMF are of the “socialized housing” category

- While HDMF has lowered its interest rates on Socialized Housing Loan Packages, it has increased its ceiling of housing loans to cater to the High Income bracket: there is a 25-75 ratio of socialized housing loans to low-cost/medium cost housing loans

- The CMP program has garnered great success but has had difficulty in processing applications due to deficiencies in the collateral; while it has targeted the whole country, only areas with good land titling systems are enrolled

- Resettlement projects are the preferred option in housing families to be relocated from danger areas, and sadly displace these families economically

- In-city relocation is very expensive and requires subsidies to ensure affordability for the families to be relocated.

- Innovative approaches promoted by NGOs and Microfinance Institutions are available, but have not been scaled up.

There is also need to clarify the following points:

- Is “Socialized housing” determined by a Ceiling under which developers can provide affordable housing units to low-income families?

- Can an in-city housing unit intended for Informal Settler families living in danger areas costing more than the Ceiling be considered as Socialized Housing?

- In addressing informal settler families, RA 7279 expands “Socialized Housing” to include sites and services development, long-term financing, liberalized terms on interest payments, and such other benefits

THE BUSINESS MODEL OF SOCIALIZED HOUSING

Based on the history of “Socialized housing” government has sought to address both the needs of the low-income earners in the formal sector and those of the informal sector with the same business model of socialized housing: a model based on housing finance anchored on a collateral. This model features the following:

- The housing unit that is compliant to BP 220 will be purchased by the beneficiary through a housing loan and a title will be issued to him

- Mortgage based : all housing programs are cost-recoverable through long-term amortizations using land as collateral

- Land as Collateral: all housing programs require titled lands with no encumberances

- “No equity”/ 100 %Loan to Value ratio: socialized housing loans are given this preferential treatment

- Origination by developers: even CMP projects are originated by mobilizers, assumes beneficiaries have no capacity in planning and determining housing requirements

- Formula Lending: the UHLP dispensed with credit examination of home borrowers; only recently has “capacity-to-pay” been the basis for housing loans.

- Supply Driven : impelled by a “housing backlog” or housing need based on projections and not by actual housing demand

This model is based on sound financing principles espoused by banks. It is good business for the banks but does not address the peculiar needs of the majority of households in the Philippines.

- Despite efforts in bringing housing programs to all parts of the Philippines through the Pabahay Caravan and Provincial Inter-Agency Coordination, there are only a handful of housing projects actually implemented due to the inability of LGUs to obtain titled lots. Given the complicated nature of land titling and land disposition in the Philippines , many areas could not avail of the regular housing programs.

- While the CMP has been hailed as a landmark socialized housing approach, “Mortgage” is still central to its identity. The SHFC is seeking to develop “non-mortgage” products because the land occupied by the community cannot qualify as collateral (encumbered, missing titles, or untitled)

- Communities immediately need sites-and services (aka slum upgrading) in the meantime that issues on the land they occupy is being addressed. Incremental improvement is more affordable and preferred.

- Why not use their house as collateral? This is a radical concept being espoused in other countries.

A EUREKA MOMENT

In 2013 the NHA and the SHFC were concerned that the costing for proposed housing projects for the Informal Settlers in danger areas might exceed the “Socialized Housing Ceiling” then of P400,000. There was a proposal to develop a new definition for low-rise housing units so that their programs could be considered as socialized housing. The solution was in reading RA 7279 particularly Article 5 Socialized Housing:

Based on this section then “socialized housing” refers to programs that shall be the primary strategy for underprivileged and homeless. If this was the construction, therefore there is no ceiling for the housing programs intended for the homeless and underprivileged. Moreover the beneficiaries may be given subsidies since RA 7279 also includes long-term financing, liberalized terms on interest payments, and such other benefits in its definition of Socialized Housing. The ceilings were therefore only applicable on the levels identified by the Abot Kaya Pabahay Law and CISFA and only pertain to the maximum allowable housing packages covered under development loans. With this knowledge, SHFC and NHA proceeded to implement their respective low-rise housing projects for the affected families despite the high cost per unit assured that their projects shall provide shelter for the homeless and underprivileged.

ADDRESSING THE DICHOTOMY OF SOCIALIZED HOUSING

It is now apparent that there is a need to acknowledge that there is a dichotomy in how the stakeholders appreciate Socialized Housing. It may be surmised that because developers have maintained their adherence to Socialized Housing based on BP 220 that they have difficulty in appreciating the objectives of RA 7279. They are in the business of selling housing units to the “homeless”, meaning those who do not own a home. There is indeed a market for housing low-income formal earners and this could be served by the traditional mortgage model. On the other hand, the socialized housing approach for the families in informal settlements will need a new radical model that will challenge the Government to develop new policies to ensure that the real shelter needs are addressed. This means that the model does not necessarily involve a house, but could be better community facilities. This is the core message of the National Informal Settlements Upgrading Strategy for the Philippines.